Contents:

There are five things you want to look for when evaluating any inside bar pattern. Notice how the second candle in the image above is completely engulfed, or contained, by the previous candle. In this case, the bearish candle represents a broader downtrend, while the bullish candle represents consolidation after the large decline. It’s mostly due to the fact that this particular strategy requires a strong trend in a market that has room to run. In other words, a trend that is strong but not exhausted.

- It means that there are not many orders coming to the market and that bulls as well as bears stay calm, and waiting for further market development.

- Investing involves risk, including the possible loss of principal.

- Visually, the body of both candles helps you identify the pattern.

- Chart patterns Understand how to read the charts like a pro trader.

- The Mother candle should engulf the second candle to validate the inside bar pattern.

Remember that on daily charts, it can still take several days for consolidation to yield a breakout. An inside bar might forecast price volatility, but it doesn’t promise to deliver that movement on a fixed schedule. If using the more aggressive stop loss strategy, this means selecting inside bars that form near the upper or lower range of the mother bar.

The 5 Characteristics of a Profitable Inside Bar Setup

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. An Inside Bar must stay completely WITHIN the range of the bar immediately before it. Our gain and loss percentage calculator quickly tells you the percentage of your account balance that you have won or lost.

This allows you to achieve a much more favorable risk to reward ratio. A favorable risk to reward ratio is needed for any setup taken here at Daily Price Action. This is true whether we’re trading an inside bar, pin bar or wedge breakout. Each and every strategy needs to be accompanied by a favorable risk to reward ratio.

Cara Mengidentifikasi Inside Bar Pada Grafik Forex

https://g-markets.net/ an inside bar breakout within a strong trend is a surefire way to make money. In this case, a stop-loss order should be placed below the middle part of the mother bar or above/below the mother bar. In order to identify an Inside Bar, traders must first identify the previous bar, or “mother bar,” which is typically the largest and most significant bar on the chart.

Practice identifying inside bars on your charts before you try trading them live. Your first inside bar trade should be on the daily chart and in a trending market. In other words, does it matter whether an inside bar or its mother bar closes in the direction of a trade? The answer is “no.” If an inside bar is properly formed and is in line with a daily chart, everything is OK.

Mother candlestick must represent a false breakout of a key level. The most significant factor of this inside bar trading strategy is the small stop loss. In this article we will discuss the identification of the inside bar pattern. And also understand the entry and exit methods specifically.

How to Trade Forex Using the Inside Bar Candlestick Chart Pattern – Strategies and Examples

Note how the price continues to trade higher after the appearance of the inside bar pattern and the confirmation of the third candlestick’s formation. I prefer smaller and “tighter” inside bars that don’t have really large mother bars…this shows more ‘compression’ and thus a stronger potential breakout from that compression. If you are a beginner or struggling trader, I suggest you avoid inside bars with big mother bars for now, see the previous example chart above for an example of an inside bar with a big mother bar. The black levels point out to the pattern’s high and low. The green arrow shows the successful breakout of the inside day formation. Note that we did have two prior attempts to break to the downside, which did not follow thru immediately.

A word of caution, most traders rush into the marker before the closing of the second candle. Sometimes, the second candle may stretch a bit longer and invalidate the pattern during its closing. So, traders should wait for the closing of the second candle and validate the inside bar candle pattern. During a bullish inside bar candle pattern the entry is above the high of the second candle. You can place the stop loss below the second candle’s low. Identification of this candle pattern is pretty simple and easy.

Trading The Reversal Pattern

Therefore the tighter this consolidation is, the more volatile the ensuing breakout will be. Of course, this isn’t always the case, but in my experience, it holds true more often than not. If you have been trading for any length of time I’m sure you have heard this one many times. As common as this saying may be, it has never lost its significance in the financial markets, especially when it comes to trading inside bars. An inside bar that forms on the higher time frame has more “weight” simply because the pattern took more time to form.

In the inside bar forex below, you can see an inside bar that occurred at the key resistance level. A price attempted to break out the inside bar upwards but then the bears took control of things, causing a price to pull back. Then a price formed a large inside bar with an impressive false breakout. The main thing to remember about spiral inside bars is that they rarely end up in strong breakouts since they indicate a consolidation period. A price moves inside a narrow range before making a big leap, especially in a trending market.

I share my knowledge with you for free to help you learn more about the crazy world of forex trading! They may not provide enough information to make trading decisions alone, traders should use them in conjunction with other indicators or analysis techniques. They require a good understanding of price action and candle patterns. They can be used to confirm signals from other indicators or chart patterns. Traders will typically look for confirmation of a sell signal by looking for bearish signals such as bearish divergence or bearish price action on the following bar.

I accept FBS Agreement conditions and Privacy policy and accept all risks inherent with trading operations on the world financial markets. Price is king but what does it take to trade price action successfully and why do so many traders struggle with it? By noise I mean frequently appearing inside bars that do not quite trigger price moves that you would expect when you trade them.

Inside Bars – The Hidden Price Action Driver – DailyFX

Inside Bars – The Hidden Price Action Driver.

Posted: Thu, 02 Jun 2022 07:00:00 GMT [source]

Supports and resistances can be very effectively used for placing Profit-Targets as well. Do you have any suggestions or questions regarding this strategy? You can always discuss Inside Bar Strategy with the fellow Forex traders on the Trading Systems and Strategies forum. Stop-loss is set to the Low of the “container” bar for the Long positions and to the High of the “container” bar for the Short positions. Avoid inside bars that form on or near the high or low of the day. Miners & PSP’s Automatically convert funds.Individuals Jumpstart your trading.Advanced traders Stay ahead of the curve.

Between 74-89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Generally, although the inside bar is a two-candle pattern, the next candle after the second is a crucial one. As a matter of fact, the trade will be taken once the third candle is over. Trading Strategies Learn the most used Forex trading strategies to analyze the market to determine the best entry and exit points. Chart patterns Understand how to read the charts like a pro trader.

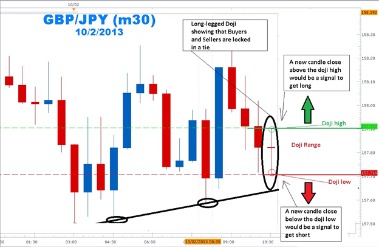

Moreover, the pattern could be either a trend reversal or continuation chart pattern, depending on the context of the markets. It is also one of the most frequently seen patterns that appear regularly in any market condition. So, as you can assume, there’s no one version of the inside bar pattern. In the example image below, we can see the anatomy of an inside bar setup. Note that the inside bar is fully contained within the range of the high and low of the mother bar.

The only thing that matters is whether the mother bar is bullish or bearish. The formation of the mother bar, in combination with the trend, is what tells you which way to trade an inside bar setup. Notice how the bullish inside bar in the above illustration formed at the top of the mother bar’s range. This is what you want to see in a favorable setup, especially if you are using the more aggressive stop loss placement, which means placing your stop loss below the inside bar rather than the mother bar. This is the ideal scenario for trading a bullish inside bar setup as the market has gained a fresh set of buyers who are ready to push prices higher. Of course the opposite holds true for trading a bearish inside bar after a break of consolidation.